Best Trading App For The UK – Find Beginner Friendly Stock Trading App

Searching for the best stock trading apps? Look no further! In this guide, we review the 2024 best trading apps in the UK. We also discuss what features you should be looking at before registering with the best free stock trading platform to help you make sure you find the best trading apps.

Best Trading App UK List – 2024

Before we review them in detail, here’s a quick roundup of the best trading app UK and the top runners-up.

- Fineco Bank – Trade over 10,000 Global Shares from Your Smartphone

- Plus500 – App with over 2,000 Tradable CFDs

- XTB – Trading App with Stock and ETF Screener

- Forex.com – Best Forex Trading App in the UK

- FXCM – App with Competitive Spreads

- AvaTrade – Best App for Technical Trading

- Skilling – Best App for Copy Trading

1. Fineco Bank - Trade over 10,000 Global Shares from Your Smartphone

Fineco Bank is another top trading app in the UK. This Italy-based broker was founded in 1999 and now boasts more than 1 million users across Europe.

A big part of what sets Fineco Bank's trading app apart is simply its selection of assets. With Fineco Bank, you can trade more than 10,000 shares from the US, UK, and Europe. Even better, you get to decide whether you want to buy shares outright or trade CFDs. Share dealing commissions are just $3.95 for US shares, and there's no commission or added spread if you trade stock CFDs.

On top of that, the Fineco Bank app offers trading for stock indices, forex, and commodities through CFDs. You can also trade stock options or build a portfolio from thousands of ETFs. Fees are low across the board and there's no minimum deposit required for share dealing or CFD trading.

Fineco Bank's mobile app is designed for ease of use. The interface allows you to seamlessly check on your positions and enter new orders. However, the app is light on technical analysis features, so it may not be the best choice if you want to dive deep into analysing price movements. Fineco Bank offers an extremely comprehensive trading platform called PowerDesk for that purpose, but it's only available for desktop devices.

Fineco Bank is regulated by the Bank of Italy and is publicly listed on the Milan Stock Exchange. The broker offers excellent customer service by phone and email, so it's easy to get in touch if you ever need help with your account.

You can join Fineco today by clicking the button below and use the code FIN100-AD to get 100 free trades!

- Assets: Stocks and ETFs, Stock Indices, Forex, Commodities, Options

- Demo: Yes

- Trade Commissions: No for CFD trading, Yes for share dealing

- Research Tools: Basic charts, Stock screener, News feed

- Account Minimums: None

- Trade over 10,000 shares from the US, UK, and Europe

- Extremely easy to use mobile app

- 100 free trades

- Could have more technical analysis tools

2. Plus500 - App for Tight Spreads

If you're purely interested in trading CFDs, then the Plus500 app is certainly worth checking out. This UK-based broker offers CFDs for a wide range of instruments, including forex, stocks and crypto, and is particularly notable for no fees.

When you trade CFDs on the Plus500 app, it's commission-free trades means you pay nothing whatsoever, and the spreads and overnight fees are among the most competitive in the business. On top of that, you don't have to pay any withdrawal fees either!

Plus500 offers its own proprietary mobile trading platform which is clear, easy-to-use and intuitive. The platform comes with equipped with some useful technical analysis tools, including basic charting, technical indicators and customisable price trade alerts which send notifications to a mobile platform.

You can open an account with Plus500 with a £100 minimum deposit, which is lower than many other online brokers best offers, and there's also an unlimited demo . It accepts a range of different payment methods, including PayPal.

When it comes to safety, Plus500 is licensed by the FCA, so you can be sure the mobile app is secure and your funds/mutual funds are protected. Its parent company is also listed on the London Stock Exchange, so it's a very trustworthy online brokers.

- Assets: Shares and Stocks, Options, ETFs, Cryptocurrencies, Forex, Commodities, Indices

- Demo: Yes

- Trade Commissions: No

- Research Tools: Basic charts on the proprietary platform

- Account Minimum: £100

- commission-free trades with variable and highly competitive spreads

- High Leverage: Up to 300:1 for some CFDs

- Stock Options: Trade CFDs for free stock options

- Few Research Tools: Basic charts and no analyst reports

- CFDs Only: No direct ownership of stocks

3. XTB - Stock and ETF Screener

If you're interested in trading stocks and ETFs, XTB is one of the top trading apps around. That's in part because this trading app offers unique tools like a built-in stock and ETF screener. You can easily use the filters to find trading opportunities, long-term investments, and everything in between.

On top of that, XTB's app is packed with features to help you analyse the market. The platform includes full-screen technical charts with dozens of customisable indicators, for example, along with trade ideas complete with annotated charts. There's also a market news feed and a sentiment gauge that shows you what other traders think about a company's prospects.

XTB has over 2,100 stocks and ETFs available for trading as CFDs from 17 global markets. You can trade stocks and funds with leverage up to 5:1, and spreads start as low as 0.015% for US stocks. If you want to expand beyond the stock market, XTB has dozens of forex pairs, commodities, and cryptocurrencies.

This broker is regulated by the UK's FCA and CySEC, so it's very trustworthy. In addition, all client accounts come with negative balance protection, so you can never lose more than you deposit. There's no minimum deposit to open an account with XTB and no deposit fee. You can fund your account with a huge range of payment methods, including credit card, debit card, PayPal, and several other e-wallets.

- Assets: Shares and Stocks, ETFs, Cryptocurrencies, Forex, Commodities, Indices

- Demo: Yes

- Trade Commissions: No

- Research Tools: Charts, Trade Ideas, Market Sentiment, News Feed, Stock Screener

- Account Minimum: None

- Trade over 2,100 stocks and ETFs from 17 markets

- Share spreads as low as 0.015%

- Built-in stock and ETF screener

- Only CFD trading so you cannot buy stocks directly

- Moderate selection of forex and commodities

4. Forex.com – Best Forex Trading App UK

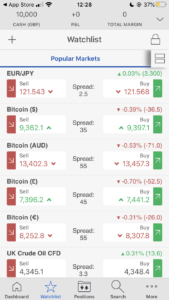

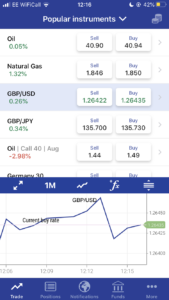

Established in 2001, Forex.com is the trading name of GAIN Capital – a U.S-based online financial service provider. Their mobile app currently supports over 90 forex pairs and thousands of other tradable instruments like cryptos and ETFs drawn from 300+ global markets. In 2019, Forex.com was considered the world’s largest MT4 broker and maintained the lowest crypto trading costs.

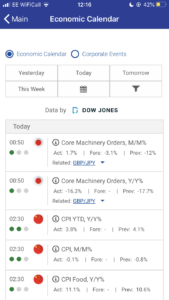

Over the years, Forex.Com has morphed into one of the largest, most popular, highly regulated and the best online trading platforms, and its mobile app offers plenty of useful features. These include advanced charts, provided by TradingView, with 14 chart types and over 65 technical indicators.

The Forex.com app is also integrated with live Reuters news, so you can easily keep track record of the latest market developments as you trade. Other useful features include customisable dashboards and watch lists, intuitive trade tickets and customisable rate alerts.

In the UK, the Forex.com iOS mobile app and Android app is licensed and regulated by the FCA and CFTC in the U.S. Registering with the Forex.com app is straightforward and only requires £50 in minimum initial deposit.

Active Traders may be treated to different types of accounts, have access to leverage of up to 1:200, and don’t pay trade commissions. Forex.com accounts are accessible via the online brokers proprietary platform as well as the conventional MT4 trading platform.

- Assets: Stocks, ETFs, Cryptocurrencies, Forex, Indices, Commodities (all as CFDs)

- Demo: Yes

- Trade Commissions: Up to 0.15% on share CFDs

- Research Tools: Wide range of trading tools, financial and market news

- Account Minimum: £50

- Trade on Forex.com or MT4 trading platform downloadable desktop and mobile trading apps

- Forex.com is a highly regulated broker licensed in the U.K, U.S, Canada, Cyprus, and Japan

- Gives you access to one of the broadest range of tradable securities including stocks, forex, indices, crypto and ETFs

- Forex.com doesn’t charge deposit or withdrawal processing fees

- There are no trade commissions and charges highly competitive spreads

- Charges inactivity fees

- There is no guarantee you’ll qualify for the maximum leverage

5. FXCM – App for Spread Betting

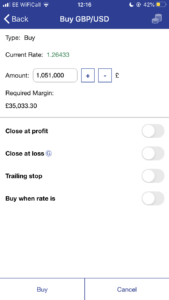

FXCM, short for Forex Capital Markets, is a popular online brokers that offers an impressive trading app. One of the notable things about this app best is that, in addition to offering CFDs for a wide range of financial instruments, it also offers spread betting.

By spread betting on the FXCM app, you don’t pay any capital gains or no stamp duty! You can also trade with leverage and, like with CFDs, speculate on both upwards and downwards movements. Spread betting and CFD trading is made easy on the FXCM app, thanks to its intuitive platform and impressive design.

FXCM offers a range of trading tools, including interactive candlestick, bar and line charts built-in chart indicators. It also supports hedging and scalping, accepts expert advisors and supports MT4, which is particularly useful if you’re trading forex. Other features of the mobile app include real-time news and educational resources such as free webinars and on-demand trading assistance from an expert trader.

You can trade with 0% commission on the FXCM app, and the spreads across the different assets are competitive. This broker is licensed by the FCA, and it’s also one of the major shareholders Jefferies Financial Group – one of the largest and highly popular London-based online brokers – so it’s a safe and secure platform.

While the FXCM app has plenty to offer, there are some negatives to be aware of. These include the fact that the mobile app doesn’t currently offer price alerts, and the high £300 minimum deposit may put off beginner active traders.

- Assets: Stocks, ETFs, Cryptocurrencies, Forex, Commodities (all as CFDs)

- Demo: Yes

- Trade Commissions: No

- Research Tools: Wide range of trading tools, financial and market news

- Account Minimum: £300

- Both the desktop and mobile apps are user-friendly and highly versatile

- FXCM doesn’t charge trade commissions and maintains highly competitive spreads

- Active traders get to interact with a wide array of risk management tools orders like trailing stop and one-cancel-other

- Charges a monthly £50 inactivity fee after12 months of inactivity

- FXCM’s proprietary trading platform is not so user-friendly

6. AvaTrade - App for Options Trading

AvaTrade is a renowned online brokers that actually offers three separate mobile trading apps - AvaTrade GO, AvaTrade Options, and AvaTrade Social.

AvaTrade GO is the main mobile app and is packed full of useful features. For starters, the AvaProtect feature means that you get money back on every losing trade, while the app also offers one click and two click trading, so you can set your preferences beforehand and then make trades in a more streamlined way. You can also watch market trends in real time. The app has CFDs for a wide range of assets and offers no commission trading.

Next up, AvaTrade Options is the best free trading app we've come across if you're looking to solely trade options. This mobile app offers advanced charting with integrated live pricing and trade executions which is excellently tailored to mobile use. You can trade options for over 40 currency pairs in addition to gold and silver, and there's also Autochartist trading signals integrated for all forex pairs.

Finally, AvaTrade Social is a social app which allows you to connect with other trades, share ideas and even copy trades. You can even create your own chat groups!

Another notable aspect of AvaTrade is that it supports Meta Trader 4 and 5, both of which are available as mobile apps. These technical trading platforms can be accessed from within the AvaTrade mobile app and provide access to loads of technical tools, trading robots and an expert financial advisor.

- Assets: Stocks, ETFs, Cryptocurrencies, Forex, Forex Options, Commodities

- Demo: Yes

- Trade Commissions: No

- Research Tools: Custom charting, MetaTrader 4

- Account Minimum: £100

- Research Tools: Includes MetaTrader 4 access

- Options Trading: Trade forex options through CFDs

- Leverage: Up to 30:1 leverage when trading free stock CFDs

- High Spreads: Pricier than other free of commission brokerages

- CFDs Only: Cannot collect dividends when trading stocks

7. Skilling - Best UK Trading App for Copy Trading

Skilling is one of the top UK apps for trading cryptocurrency, stocks, forex, and more. The platform has a selection of more than 1,000 CFDs, including 700 share CFDs. You can trade most popular cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple.

Part of what sets Skilling apart is its selection of trading platforms. You can use Skilling’s own mobile app for iOS and Android, which is quite comprehensive. It’s packed with technical indicators and tools like watchlists and a market news feed. In addition, Skilling gives all traders access to cTrader and MetaTrader 4, both of which offer powerful mobile apps for running technical analysis on the go.

Skilling also has a very advanced copy trading platform that gives you access to thousands of different trading strategies. For any strategy, you can see what it’s trading goal is, how successful it has been, and whether it uses leverage.

Skilling doesn’t charge account fees and all CFD trades are 100% commission-free. On top of that, you can open a new account with just a £100 minimum deposit.

- Assets: Stocks, Cryptocurrencies, Forex, Commodities (all as CFDs)

- Demo: Yes

- Trade Commissions: No

- Research Tools: Custom charts, MetaTrader 4, cTrader, copy trading

- Account Minimum: £100

- Supports cTrader and MT4

- Trade shares, forex, crypto, and commodities

- Copy trading with thousands of strategies

- Limited selection of global shares

- Moderate CFD spreads

Our Video Tutorial helps to demonstrate the features one should look for in the best online trading app:

Are trading apps legit in the UK?

Yes, apps for trading stocks, forex, crypto, and other assets are authorized and licensed to operate in the UK, where they are monitored by the Financial Conduct Authority (FCA). Therefore, when looking for the best trading app in the UK, you need to first ensure that they are authorized and regulated. The best share trading apps must abide by FCA regulations limiting the amount of leverage advanced to retail traders to 30:1 and subjecting their clients to the regulator-approved KYC and AML procedures.

To qualify for an operating license, an app must also meet stringent security measures aimed at keeping their client’s data and mutual funds safe. You must, therefore, ensure that you only register with the FCA-regulated trading app.

What are the best trading apps for beginners?

When looking to open an account with the best trading app for beginners, you have to consider such factors as the level of customer assistance advanced, available trading and technical analysis tools, and the user-friendly intuitiveness of their platform.

FXCM is a favourite app for beginners because of the wide range of risk management tools availed by the broker. These make the transition from the demo environment to the live account seamless by minimizing their losses. On the other hand, beginners looking for low-cost trading and the most transparent broker charges will also consider Skilling.

What should you look for in the best trading app?

Getting the right trading app is essential to your success as a trader. You need a mobile app that not only lets you trade the assets that you want to invest in, but that can help you spot opportunities for profit in real-time by putting key tools at your disposal. Plus, your app needs to do all of this without charging an arm and a leg every time you open or close a position.

To help you find the best UK trading app for you, this table shows how our recommended mobile apps match up against each other in terms of tradable assets, minimum deposit and features. Continue reading to see how they match up in terms of fees.

| Trading app | Tradable assets | Minimum deposit | Trading app features |

| Plus500 | Crypto, indices, forex, commodities, stocks, options, ETFs | £100 | Basic charting, price alerts |

| XTB | Forex, commodities, indices, stocks, crypto | $0 | Advanced charts, news feed, stock screener |

| Forex.com | Forex, commodities, indices, stocks, crypto | $50 | Advanced charts, Reuters news |

| FXCM | Forex, stocks, indices, commodities, crypto | £300 | MT4, webinars |

| AvaTrade | Forex, crypto, commodities, stocks, indices, ETFs, bonds | £100 | MT4/5, social trading |

| Skilling | Forex, stocks, indices, commodities, crypto | £100 | MT4, cTrader, copy trading |

| Investous | Forex, stocks, crypto, indices, commodities | $250 | MT4, charting |

What Assets Can You Trade?

The first and most important factor you need to consider is what assets a trading app allows you to buy and sell. There are tons of stock trading apps for investing in free stock and ETFs, but these asset classes make up just a small part of the total investment market. All of our featured best stock trading apps let you trade stocks and ETFs along with forex, cryptocurrencies, and commodities. Even better, look for brokerages that offer options trading for stocks, forex trading, or both.

Even if you’re only interested in trading one type of asset right now, having multiple asset classes available can help you in the future. If market conditions change, you can immediately shift to trading a different type of asset or diversify your portfolio. Plus, you can take advantage of opportunities in other markets or diversify your portfolio.

On top of asset variety, you’ll also want to consider how you’re allowed to trade with any brokerage. For example, while most brokerages only let you buy and sell CFDs and not the underlying assets, others let you invest in shares directly or trade them indirectly via stock CFDs.

Apps for trading stocks

Most trading apps in the UK let you trade stocks. However, not all share trading apps are made equally. Some apps only carry UK and US shares, while others have shares from around the world.

In addition, think about whether you want the option to trade penny stocks. While penny stocks can be high risk, they can also help you diversify your portfolio and make big bets on young companies.

Apps for forex trading

Forex trading apps need to have a wide variety of currency pairs, ultra-fast trade execution, and low spreads. Ideally, they should also have advanced technical analysis platforms that enable you to follow miniscule changes in the currency market. For any app that offers MetaTrader 4 or 5, you’ll be able to use forex signals in your trading.

Apps for trading cryptocurrency

Cryptocurrency trading apps like Skilling and others let you buy and sell digital currencies – or, at least, CFDs for these currencies. Look for a wide selection of cryptocurrencies, including altcoins like Ethereum, Litecoin, and Ripple. You should also have access to the same technical analysis tools for crypto trading as you do for trading stocks and forex.

What are the trading fees and commissions?

Cost is another major factor when choosing a trading app. Thankfully, an increasing number of brokerages are doing away with double fees in the form of trading commissions and spreads.

Spread refers to the difference between what an asset can be bought for and what it can be sold for at any time. These vary from one tradable financial instrument to another.

If you chose to copy trades from other active traders, you will have to part with a commission of 20% of the profits realized while the overnight trading fees (charged on stock trades that remain open overnight and on weekends) is dependent on such factors as the transaction volume and the type of securities traded.

| UK Stock Broker Fees | Commission | Inactivity Fees | Banking Fees |

| Plus500 | 0% Commission | $10 per month after three months of inactivity | None |

| Forex.com | Up to 0.15% on share CFDs | £13 per month after one year of inactivity | £25 on same day withdrawals under £5,000 via CHAPS Bank Transfer |

| FXCM | 0% Commission | £50 per month after one year of inactivity | None |

| AvaTrade | 0% Commission | $50 per quarter after three months of inactivity | None |

| Skilling | 0% Commission | None | None |

| Investous | 0% Commission | 80 EUR per month after one month of inactivity | 3.5% for debit/credit cards, $30 for wire transfer, 3.5% for Neteller |

| Hargreaves Lansdown | £11.95 per share deal | None | None |

Which trading app has a smooth onboarding process?

The ease of registering as an online trader varies from one trading app to another. Some mobile apps have relatively easy and straightforward registration while others may be considered rather complex.

You will only need to upload identification documents when making a deposit. Though manual, the documents verification process is quite fast. The same, however, can’t be said of FXCM which takes up to two days to approve the verification documents and open an account.

What is the difference between forex trading apps and the best stock trading apps?

The primary difference between a forex trading app and a stock trading app is that while forex trading apps are dedicated to trading currencies, stock trading apps are dedicated to trading stocks and shares. Other differences between these mobile apps revolve around trading charges and how they treat leverage.

In the UK for instance, a forex trading app will only grant you access to leverages of up to 30:1 while stock trading apps have leverages of up to 2:1. The best stock trading apps will also be commission-free while forex trading apps juggle between the commission and commission-free mobile apps.

What are the available trading tools

Your mobile trading app should be more than just a trading platform. For you to succeed as a trader, your chosen platform should have all the necessary research tools, technical indicators, feature customizable charts, and offer a platform for discussions with other traders.

The first thing that most traders will want to look for in a mobile trading app is technical charts. These are essential to understanding recent and long-term price movements and predicting what’s to come.

The best stock trading apps offer some form of technical charts, either through their own custom software or integration with third-party software like MetaTrader. If your broker has their own charting system, make sure it offers all of the indicators and technical studies you need. It’s even more promising if it includes an automated alert system.

Other helpful tools to look for include news feeds, summarised financial data points for companies and industries, and analyst reports. These resources are important to both technical and fundamental traders in helping them speculate on market trends.

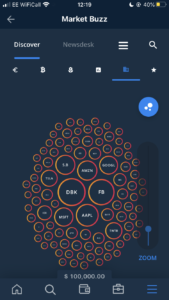

Finally, consider whether social trade is important to you. Beginner traders especially can benefit from being able to see what other traders are holding and to copy their strategies automatically. But, even advanced traders can use copy trading to their advantage as a way to quickly diversify their portfolios. Social trades can also help you gauge market sentiment around specific assets or industries.

Customer Service?

While most traders will never need to contact their brokerage for assistance, it’s critical that help is there when you need it. Look closely at what types of support your mobile trading app offers; whether it’s by phone, email, live chat, or another method of communication and when it’s available.

Along the same lines, educational resources can be a big help for traders looking to take their profits to the next level. Many of the best trading apps have a library of guides and articles to help you understand the intricacies of different types of assets or to explain new strategies.

But if you still have questions about investments you should contact a financial advisor.

Conclusion

Finding the best UK trading app is key to succeeding as a trader. With so many mobile apps on the market right now, there’s never been a better time to jump into trading. But, it’s important for first-time traders to choose your mobile trading app carefully so you get the one that’s most suited to your needs. Our five featured best trading apps are a good place to start honing your trading skills.

If you’re looking for other investment options check out this check out the best investment apps in the UK.